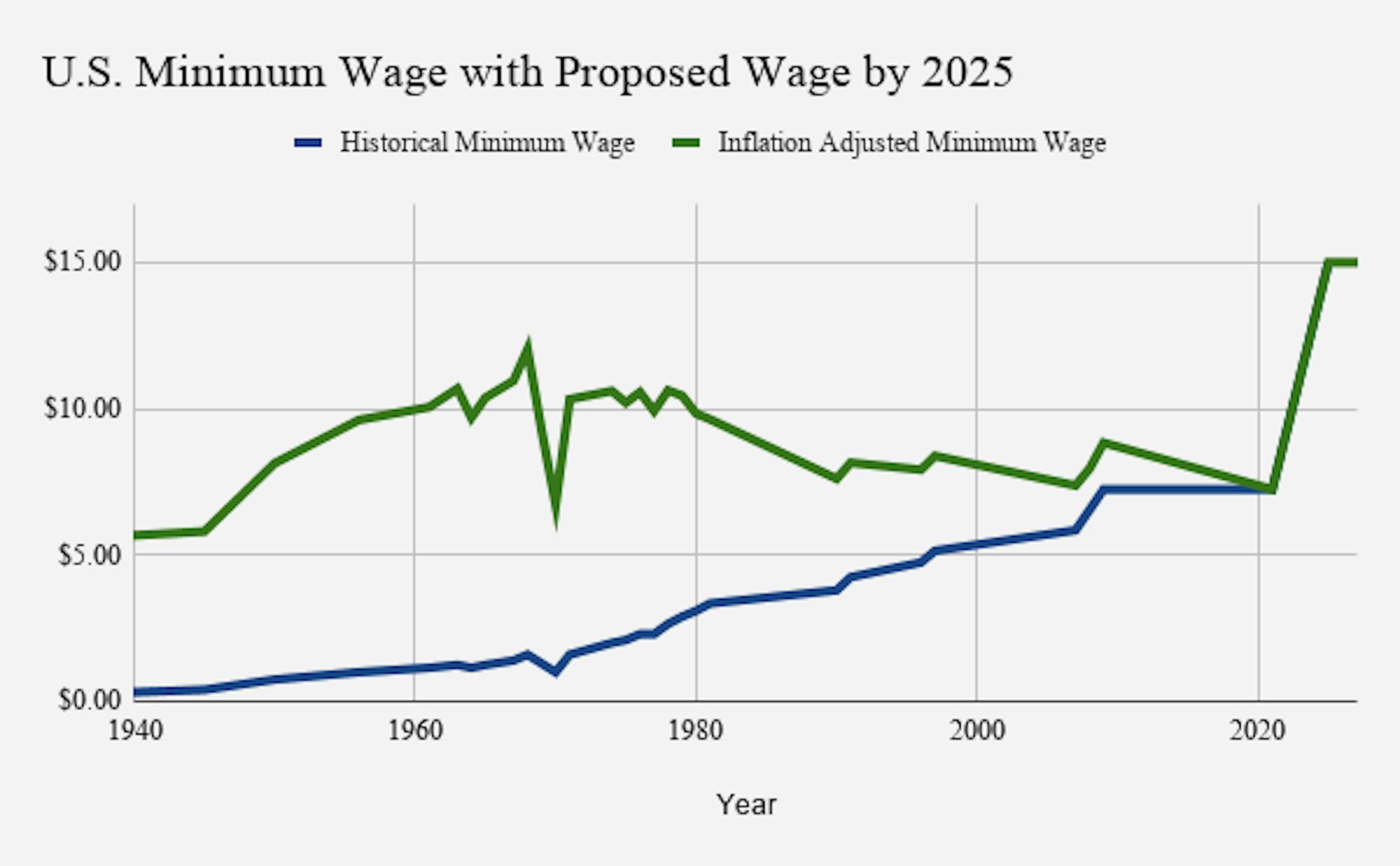

The Raise the Wage Act, recently proposed in the House of Representatives, promises an annual increase in the minimum wage until it reaches $15 an hour by 2025, as well as an index to continue raising the minimum wage at the same rate as median hourly wages.

Two Notre Dame professors proficient in economic policy, Forrest Spence and Rüdiger Bachmann, said they support a moderate increase in minimum wage but express some concerns that such a drastic change, more than doubling the current national minimum wage, could have some unintended consequences.

“From an economist’s standpoint, I’m surprised that the proposal is such a huge increase relative to what the current federal minimum wage is, $7.25 currently,” Spence, an assistant teaching professor in the department of economics, said.

Both Spence and Bachmann, an associate professor of economics, cited the Congressional Budget Office’s report that the proposed minimum wage would raise 0.9 million Americans out of poverty at the cost of 1.4 million jobs.

Bachmann and Spence said that even these nonpartisan Congressional Budget Office predictions may not be perfect due to the magnitude of the increase on a national level and the lack of prior research on national minimum wage increases.

“These numbers come with uncertainties because we don’t have good evidence for when you combine substantial with national increases,” Bachmann said.

Bachmann and Spence both support a more moderate increase in national minimum wage coupled with targeted, localized increases in part due to the large discrepancies between standards of living and current minimum wages in cities across the country.

“It’s clear that the federal minimum wage should rise. It hasn’t been adjusted for a long time,” Bachmann said. “It’s not clear to me that $15 an hour won’t be doing more damage than good in those [low-cost of living] areas. The better solution would be to raise the federal minimum wage more modestly.”

Spence also said he was unsure if such an increase would be economically feasible.

“I’m in favor of raising the federal minimum wage by a small amount and indexing it, but I think $15 an hour is kind of crazy in the sense that we just don’t really know what is going to happen,” he said. “I think you run the risk of hurting the people that you’re trying to protect the most and also generating more political polarization.”

Both professors cited Seattle, a city that is already in the process of raising minimum wage to $15 an hour, as an example of a community that would face little disruption due to the new policy. In contrast, an area like South Bend would be disproportionately impacted by the sharp spike in minimum wage, Spence said.

A $15 minimum wage could even influence the University of Notre Dame and its employees, Bachmann and Spence said.

Spence said that if a large number of Notre Dame employees are making less than $15 an hour and now have to be paid $15, it might help some employees get a raise; however, it could also lead to some layoffs and tuition increases in the long run.

“I don’t think Notre Dame will get stuck with the bill, that will be ultimately the students,” Bachmann said.

Dennis Brown, university spokesman and assistant vice president of news and media relations, said in an email, “The vast majority of our non-exempt employees are paid more than $12 per hour in base pay. When factoring in the value of the total rewards, the total value of both compensation and benefits exceeds the local market by more than 18%.”

Brown also said that the University offers a host of resources and benefits to the staff. Spence said that these benefits could be in jeopardy if there’s an increase in minimum wage.

“We also don’t want to lose sight of the fact that there’s lots of other benefits that workers get in addition to just wages,” Spence said. “One concern, more generally and specific to Notre Dame, would be if you impose a minimum wage, do firms and organizations have to scramble to cut back on other benefits rather than fire people?”

In addition to discussing the possible impacts for the University, Bachmann also expressed broader concerns over how firms will react to the changes nationwide.

“A lot of people will benefit from it [new minimum wage laws], at least in the short run,” Bachmann said. “The problem is, of course, and here’s the downside, in the long run, it’s very often the case that firms will adapt business models.”

In fact, forward looking firms might already be making changes today in anticipation of minimum wage increases, Bachmann said.

Bachmann illustrated this point with two examples — automation in airports and fast food restaurants.

In Europe, where wages are typically higher, travelers see fully automated baggage pick-up systems, but in the U.S., where the minimum wage is much lower, travelers may notice service workers still tend the conveyor belt, Bachmann said.

He explained McDonald’s and other fast food chains still hire low wage employees to work in their restaurants, but these businesses may turn to automation if the minimum wage increases significantly.

“The technology is there,” Bachmann said. “It’s probably just not yet economical for McDonald’s to do that. It’s still a better deal for them to pay people extremely low or minimum wages.”

While some may consider these jobs of little value, Bachmann said they may be more essential.

“It’s not so clear how good it is to eliminate these jobs in the long run,” he said. “You might face a crisis of low-skilled workers that are slowly substituted out by computers or robots and other things.”

Bachmann also said this increase in minimum wage might be the first step towards a universal basic income, especially if it displaces a significant number of low-skilled workers who have no other employment options.

Spence said one upside of the minimum wage could be an increase in better-paying jobs.

“Raising the minimum wage doesn’t just impact people at the lower end of the wage distribution.” Spence said. “There’s this added benefit that if you make lower wage employment more expensive, high wage employment is relatively cheaper than it previously was.”

Spence said students should care about these possible changes in minimum wage, regardless of whether or not it directly impacts them.

“...big, bold public policy initiatives have huge implications for economics and for the social fabric of the country.”

Read More

Trending