Mortgage rates have hit a 20-year record high, but buyers are still eager to purchase homes in South Bend, Indiana.

“People want to buy a house even though the interest rates are up right now,” said Jan Lazzara, a real estate agent who has worked in St. Joseph County for more than two decades. “As long as we’re not overpriced, we’re seeing multiple offers.”

Although mortgage rates are slowing the home market across the country, buyers still face competition in South Bend due to limited inventory.

The South Bend-Mishawaka area placed ninth for best emerging housing markets, according to the Wall Street Journal and Realtor.com. The summer ratings indicate areas with appreciating home prices, a strong local economy and attractive lifestyle amenities.

Many cities which placed in the top of the rankings were affordable Midwestern cities. South Bend is no exception. According to Realtor.com, the median housing price in South Bend was about $188,000 in July 2023, compared with a national median housing price of more than $400,000 this year, as reported by the U.S. Census Bureau.

“Generally speaking, I expect home prices in South Bend to be lower than most of the country,” said John Stiver, a Notre Dame finance professor who teaches macroeconomics.

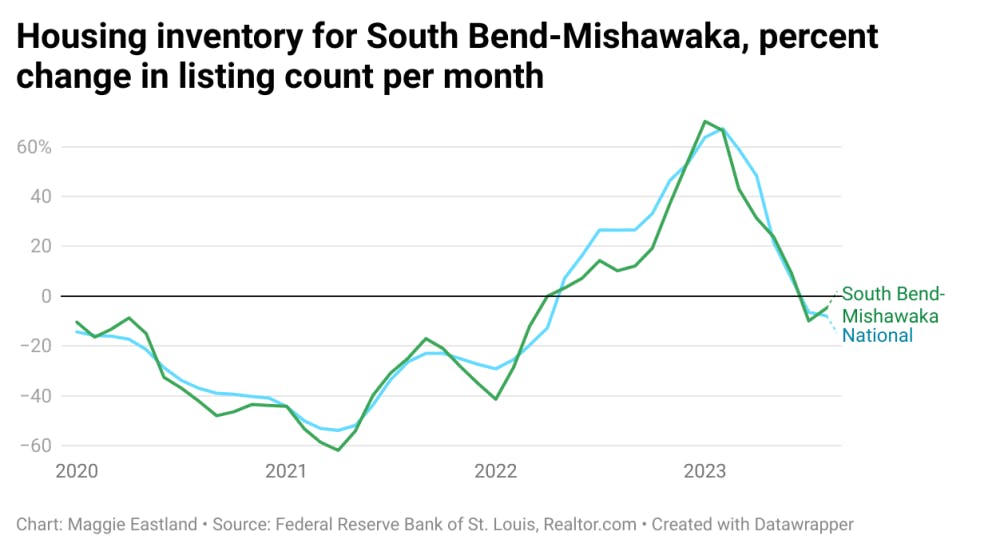

After a 11-year incline, housing prices in the U.S. began falling on an year-over-year basis this April. In South Bend-Mishawaka, prices are still increasing, though not as quickly as in 2022. Between the second quarter of 2023 and the second quarter of 2022, the South Bend-Mishawaka all-transactions housing price index increased 9.2%, the slowest year-over-year increase since the beginning of 2021, according to data from the U.S. Federal Housing Finance Agency and the St. Louis Federal Reserve.

“It looks like the rate of change of prices is going down,” Stiver said about South Bend-Mishawaka.

The average South Bend home value at the end of July was 4.6% higher than the same time last year, according to a Zillow report. The majority of homes in South Bend were sold for equal to or more than asking price in August, according to a Rocket Homes report.

“It’s been wonderful, one of my busiest years yet,” Lazzara said about the market. “The problem that we’re having is that there’s not a lot of inventory.”

Across the nation, housing inventory is down about 8%, according to data from the St. Louis Federal Reserve. In the South Bend-Mishawaka area, housing inventory decreased about 5% between August 2022 and August 2023.

Due to record-high mortgage rates, many existing homeowners don’t want to put their homes on the market and give up low interest rates.

“People are afraid to list because they have a low interest rate,” Lazzara said.

But the

high interest rates aren’t strangling buyer demand.

On a home she listed last week,

Lazzara received three overbid offers in less than a couple days. Another one of her listings received 27

offers.

She said a large portion of demand is from first-time home buyers looking

for homes in the $150,000 to $300,000 price range. Many are moving to St. Joseph County for jobs at Notre Dame and

the local hospitals.

According to data from the U.S. Census Bureau, the population

of South Bend and St. Joseph County remained relatively unchanged between April 2020 and July

2022.

Even though the local population is not increasing and the costs of borrowing

are high, limited inventory is keeping prices high. For those who are moving, finding a home near South Bend is

difficult.

Tim Travis, chief executive for a local medical foundation, closed on a

home in Granger, Indiana in March 2023. Travis, his wife and three sons moved from Louisville, Kentucky because of a

job promotion that came with a significant moving package.

“I couldn’t have moved

up here and benefited from it for less than $100,000 probably,” Travis said.

Although Travis traded a 3% mortgage rate for a rate of about 5%, he said the promotion justified the

higher mortgage payments.

Still, “it would make a huge difference in my mortgage

payment if rates came down,” he said. “I’d like to put those couple hundred dollars towards something

else.”

Last spring, Travis had a hard time finding homes for sale, especially in

his desired school districts. Travis moved to Indiana in November 2022 before his family joined up with him. He

spent months looking for the right home.

“I was on it two to three days a week. It

was like a second job, looking for housing,” he said. “It’s like going into a department store to look for clothes,

and there’s no clothes.”

When he finally found a 5-bedroom, 5,400 square foot home

in a school district his family liked, he quickly put in a competitive offer just under

$600,000.

Travis got the house. He also gained a deeper understanding of limited

housing inventory in St. Joseph County.

“The interesting thing about it all is that

the housing supply has gone down because people can’t move,” Travis said. “I wouldn’t want to be looking right now,”

he said a few months after his March 2023 closing.