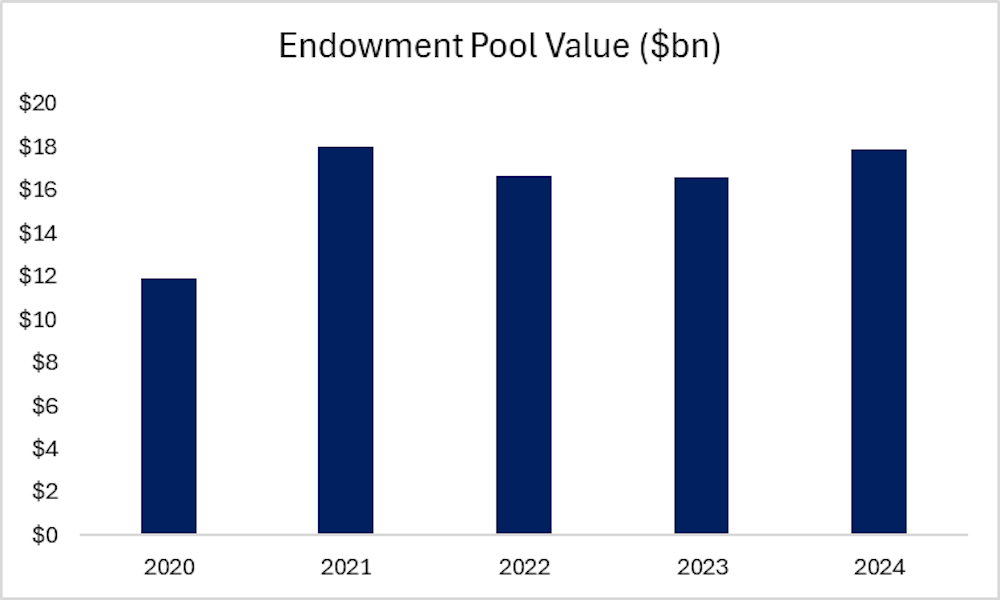

Notre Dame’s 2024 Annual Report announced a 10% return on the University’s endowment, bringing its total value to $17.9 billion. The total value of the University's investment portfolio, which encompasses the endowment, working capital and additional assets, is now $20.4 billion. Coming on the heels of two consecutive years of little to no growth, the University’s portfolio rebounded.

In the past, the main driver of the endowment pool’s growth has been the University’s investments in private equity.

“The endowment portfolio has an equity bias, given that both public and private equity have well outpaced investment returns on other assets over longer timeframes,” Tim Dolezal, vice president and chief investment officer, said. “We target 40% to private equity, 35% to public equity and 25% to our lower-risk multi-strategy portfolio.”

In 2024, the stock market managed an 18.4% return, while private markets remained relatively constant. They have been relatively quiet in recent years while waiting for economic activity to pick back up.

“You were seeing limited amounts of M&A [mergers and acquisitions] activity post-COVID, and because of that, the demand for buying these companies is going down,” Jason Reed, associate faculty director of the Notre Dame Institute for Global Investing (NDIGI), said. “Then the price that company would pay in the market would go down, right? And therefore returns would also go down.”

According to the report, one of the key guiding principles of the endowment is its “intergenerational time horizon.” The growth of the endowment benefits not only current students, but also future generations — those who will be at Notre Dame 10 or even 20 years from now. With a focus on long-term returns, the investment office places less emphasis on short-term results.

“If you look at any given year historically, it’s a coin flip whether private equity outperforms public equity, but over ten-year periods, private equity has outperformed public equity consistently,” Dolezal said.

With that in mind and considering the positive results last year, the Notre Dame Investment Office is sticking to their guns, trusting that results will materialize in the long run.

“I think the Investment Office is going to stay the course and continue to make their contributions to the operations of the University,” Reed said.

Dolezal said his office’s methodology on the private side can be broken down into two categories.

“One, investing in breakthrough technologies at the earliest possible stages alongside the world’s leading venture capitalists, and two, investing in small and medium sized enterprises managed by owner/operators that generate returns by growing those companies and improving them,” he said.

However, investing endowment money requires a slightly different process than opening the Robinhood app on a smartphone and tapping a few buttons.

“The endowment team seeks out other equity managers and looks at their strategy to determine if they them want to partner with the University,” Reed said. If it is determined to be a good fit, he explained, “we’ll allocate a portion of the endowment to the money managers to then invest using their strategy.”

Without the connections to these firms, the endowment would not have such a successful track record, Reed explained.

“Because we have been executing this strategy for 40 years, we have a unique portfolio and set of relationships, especially in venture capital, that we could never replicate today if we were starting from scratch — it is one of the University’s most valuable assets,” Dolezal said.

When selecting firms to partner with, the investment office begins by considering what sets Notre Dame apart from other top-20 universities. Each holding and investment in the endowment is carefully reviewed to ensure it aligns with the Catholic values of the University and complies with the U.S. Conference of Catholic Bishops’ Socially Responsible Investment Guidelines, which provide a framework for investing in line with Catholic principles.

“We focus on building partnerships with investment firms who have a deep expertise in their specific field and a strong, driven, partnership-oriented team,” Dolezal said. “At the end of the day, our returns are driven more by who we partner with than what we specifically own, though the latter is a direct result of the former.”

According to the report, the endowment paid out $607 million in 2024, an increase of 6% from 2023. $232 million of the payout went towards undergraduate scholarships and graduate fellowships. Notre Dame awarded $430 million in 2024 for scholarships and fellowships.

“We recently announced that going forward, Notre Dame will be both need-blind and loan-free for domestic and international students as we redouble our efforts to make a Notre Dame education even more accessible and affordable,” University President Fr. Robert Dowd wrote in the introduction to the report.

The University’s operating expenses for the year totaled $1.67 billion. 13% of the payout was allocated to general operations, while 4% went to athletics and the remaining 83% supported academic programs and research.

Dolezal, who took over as Chief Investment Officor on July 1, 2024, noted that the culture of the Notre Dame Investment Office, made up entirely of Notre Dame alumni, was the main reason for their sustained success.

“We are the only endowment [of the 20 largest endowments] whose returns rank in the top three over the past one, five, ten and 20 fiscal years,” he said.

Despite the success, the University continues to strive for more, Dolezal explained.

“We need to be maniacally focused on getting better every day,” Dolezal said. “If we do a great job, Notre Dame will be an even greater force for good in our country, our world, and our church. It is an incredible blessing to be in a position to make an impact on something that you love and believe in deeply.”